Top Five Trends Impacting the Intermodal & Logistics Markets

From shifting trade flows to infrastructure investment and sustainability, the intermodal and logistics sectors are navigating a dynamic landscape in 2025. Engineering firms serving these markets should take note of five emerging trends that are shaping client priorities and influencing project pipelines.

1. Sustainable Energy Solutions Gain Traction

The intermodal sector is under pressure to reduce its carbon footprint, and rail freight is leading the charge with long-term sustainability initiatives. Hydrogen-powered locomotives now emit roughly half the CO₂ of traditional diesel engines (Kaci Intermodal), while solar-powered rail networks are gaining traction. Rail operators are also exploring wind energy to power terminals and support electrification. These developments are creating new opportunities for engineering firms to support clients with sustainable infrastructure design. Michael Vanderbeek, GHD’s Maritime & Coastal Planning Lead for North America, underscored the shift in the latest Market Edge Podcast: “Ports are evolving into energy hubs. They’re not just moving cargo anymore—they’re supporting offshore wind, hydrogen, and the electrification process.”

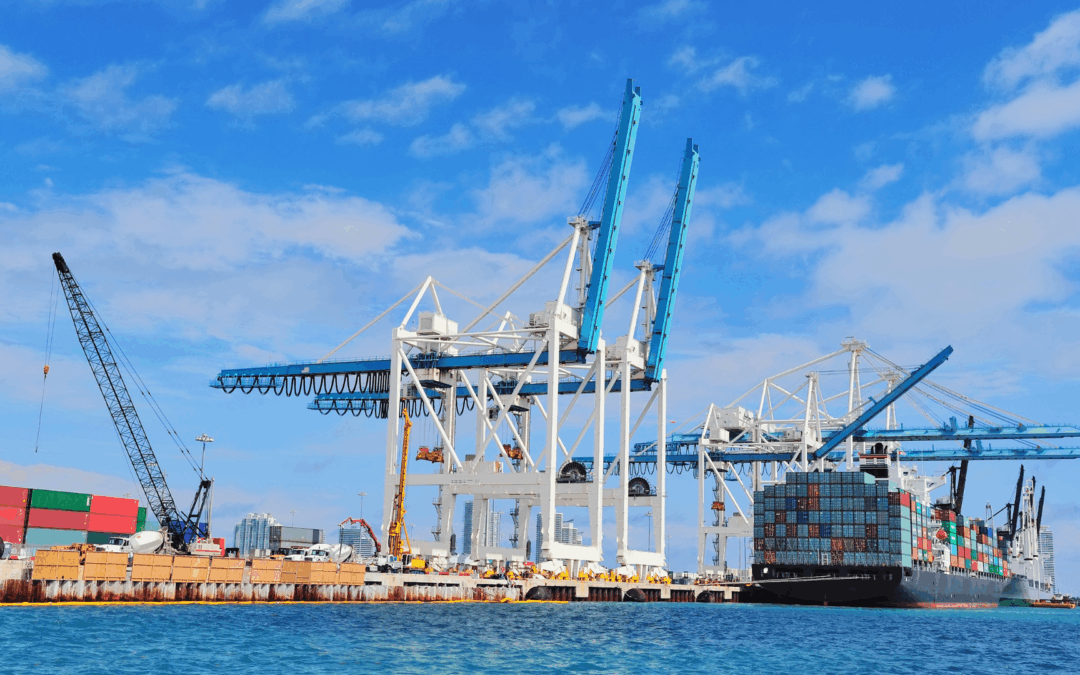

2. Trade Policy Pressures Ship-to-Shore Crane Orders

Marine terminals are facing uncertainty as new policies threaten the flow of cargo-handling equipment from China. Currently, 165 Ship-to-Shore cranes are scheduled for delivery to U.S. ports over the next decade. However, under the “Restoring America’s Maritime Dominance” Executive Order, these imports could face tariffs as high as 270% unless exemptions are granted. In June, the National Association of Waterfront Employers (NAWE) urged the administration to consider a three-year transition period to avoid supply chain disruptions. Engineering firms should prepare for potential shifts in procurement strategies and increased demand for domestic equipment design and integration. Carl Bentzel, Commissioner at the Federal Maritime Commission, emphasized the stakes in ACEC’s Market Edge Podcast: “Chinese manufacturers produce 96% of the world’s ship-to-shore cranes, giving them market dominance. However, the U.S. government has signaled its intent to discourage further purchases from China.”

3. Cold Storage Demand Heats Up

The global cold storage market surpassed $190 billion in 2024 and is projected to grow at a robust 17% CAGR through 2030 (Cushman & Wakefield). Nearly 90% of food operators now rely on frozen products to mitigate supply chain disruptions—a trend influenced by older millennials’ preference for frozen meals (AFFI). Temperature-controlled facilities such as freezers, coolers, cross-docks, and tri-temp warehouses have become essential to intermodal logistics. Meanwhile, IoT-enabled air cargo systems are enhancing real-time monitoring of sensitive goods like pharmaceuticals. With cold storage investment typically strengthening in low-interest rate environments, engineering firms should expect continued demand for design services in this resilient asset class.

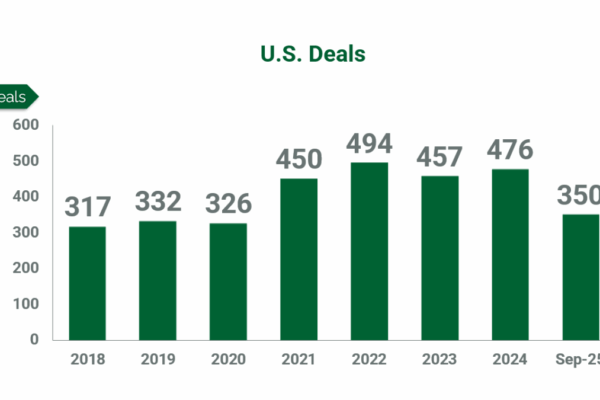

4. Resilient Growth in U.S. Manufacturing Construction

U.S. manufacturing construction hit a record $238 billion in June 2024, with spending projected to remain strong at $234 billion by 2029 (FMI). This sustained investment reflects confidence in domestic industrial infrastructure. Evolving tariff policies and reshoring efforts are reinforcing this momentum, while a decline in interest rates could unlock additional capital and spur investor activity. Engineering firms should align with clients pursuing new manufacturing facilities and retrofits, especially as industrial building demand remains elevated across key regions.

5. Import Volumes Rebound Despite Tariffs

Container volumes surged in July 2025, rising 20.4% month-over-month—a net gain of 379,578 TEUs, according to the Descartes Global Shipping Report. This marks the second-highest import volume since May 2022, signaling either market stabilization or strategic frontloading ahead of anticipated trade policies. Chinese imports, which had dropped 28.3% year-over-year in June, rebounded by 44.4% in July, driving the bulk of the increase. Engineering firms should anticipate increased demand for port infrastructure upgrades and capacity planning as clients respond to shifting trade volumes and tariff uncertainty.

Despite tariff headwinds and uneven freight demand, the intermodal and logistics markets remain active and opportunity rich. Engineering firms that stay ahead of these five trends will be well-positioned to support clients navigating a rapidly evolving supply chain environment.