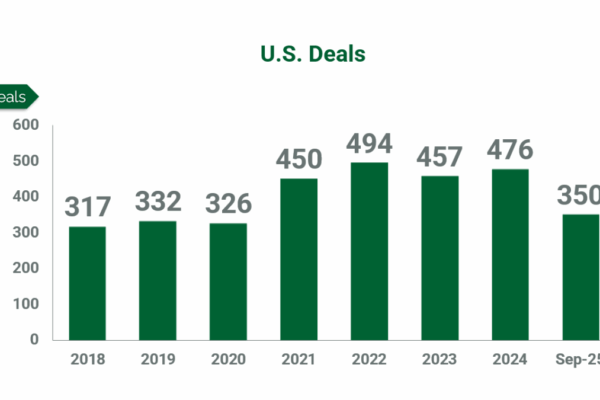

M&A Market Remains on a Roll

The good times in the engineering industry keep on rolling—driven by continued demand for services, substantial public sector and institutional funding, and sustained interest from public equity. Fueled by robust backlogs and balance sheets, engineering firms are investing in both organic and acquisitive growth initiatives.

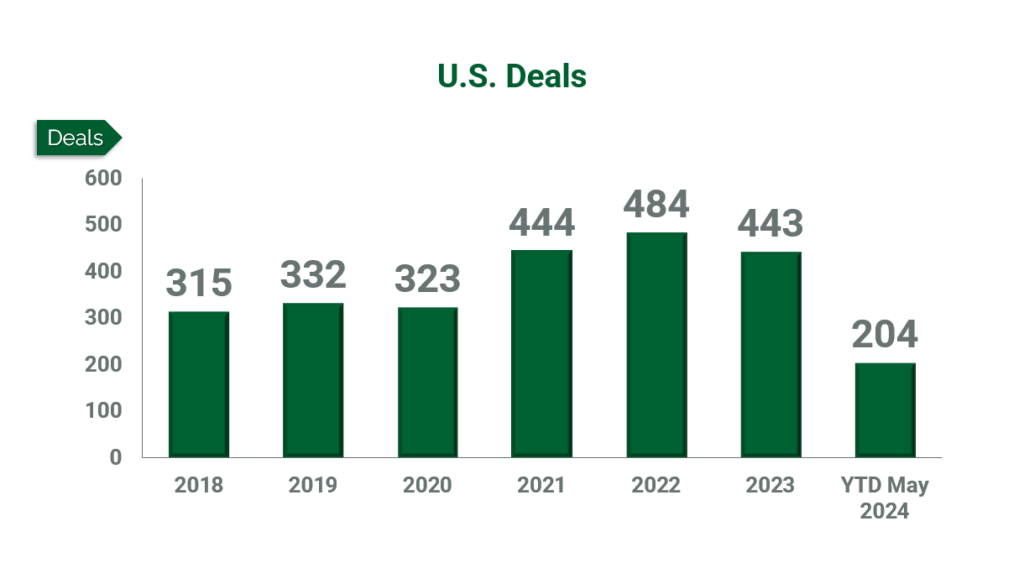

Since the start of 2021, the A/E and environmental industry has experienced a record level of consolidation—with more than a merger a day. And there’s no sign of a slowdown. Morrissey Goodale tracked 204 transactions of U.S. design and environmental firms through the end of May. If trends hold, this tally will be a new all-time deal-making record.

Based on Morrissey Goodale’s analysis of deals completed in the second quarter of 2024, the size of buyers and sellers continues to increase. For as long as records have been kept, the median acquirer size has never exceeded $98 million in gross revenue, and the median seller size has consistently ranged between $2.5 million and $3.5 million. Over the first five months of 2024, however, the revenue of the median size acquirer ballooned to $147 million, while the median seller size jumped to $4.25 million.

Live m&A Activity

To view the most up-to-date and “live” versions of the M&A heat maps, and to see who are the buyers and sellers in each state, go to www.morrisseygoodale.com.

The first change is easier to explain: Bigger buyers are getting more active. It’s harder to say, though, why the seller size has increased. One theory is that buyers are reallocating their limited M&A deal-making resources to execute relatively more, larger “needle-moving” deals. Another theory is that private equity firms, which make heavy use of debt, have been increasingly active and targeting larger sellers since those acquisitions are not heavily dependent on hard-earned equity to finance. Whatever the reason, it’s bad news for smaller firms that have been shut out of deal-making.

Reflecting on the recent supersizing of transactions, 19 Engineering News-Record (ENR) 500 design firms were either sold or recapitalized in the first eight months of the year, including the third-quarter announcements of WSP (Montreal) (ENR #5) entering into an agreement to acquire POWER Engineers (Hailey, Idaho) (ENR #26), as well as Gannett Fleming’s (Camp Hill, Pa.) (ENR #29) strategic merger with TranSystems (Kansas City, Mo.) (ENR #58).

Second-quarter acquisitions included AKF Group (New York City) (ENR #318) by WSP (Montreal) (ENR #5), CT Consultants (Mentor, Ohio) (ENR #339) by Verdantas (Tampa, Fla.) (ENR #113), and P2S (Long Beach, Calif.) (ENR #308) by Legence (San Jose, Calif.). In comparison, only 16 firm sales or recapitalizations among the ENR 500 were reported in all of 2023.

Employee-owned buyers accounted for just over half (106) of the deals completed through the first five months of 2024, while just 8 percent of transactions (16) featured publicly traded buyers. Another 40 percent of deals (82) were either purchases by private equity-backed operating firms or recapitalizations by private equity groups—a trend Morrissey Goodale has been monitoring since 2018, particularly among top engineering firms.

In Q2 2024, ACEC member firm Infrastructure Consulting & Engineering (West Columbia, S.C.) (ENR #205) received a strategic investment from private equity firm Godspeed Capital Management (Washington, D.C.), while Sterling Investment Partners (Westport, Conn.) purchased a majority stake in Verdantas from Round Table Capital Partners (Miami).

Prolific Buyers in Q2 2024

Member firms that made multiple acquisitions included:

- Verdantas

- NV5 (Hollywood, Fla.) (ENR #24)

- LJA Engineering (Houston) (ENR #67)

- Bowman Consulting Group (Reston, Va.) (ENR #78), recipient of Morrissey Goodale’s 2024 Most Proficient and Prolific Acquirer Award.

M&A Hotbeds

Sun Belt firms remain top M&A targets. California (24), Florida (23), and Texas (19) accounted for nearly one-third of all A/E and environmental industry deals in the first five months of 2024.

Overseas acquirers are still showing interest in the U.S. market, yet they represent just a fraction of buyers. Only 5 percent of transactions in the first five months of the year involved a foreign buyer. Although that figure is up from 3 percent in 2023, the last time overseas acquirers played a significant role in U.S. industry consolidation was back in 2017, when they accounted for 10 percent of deals. While we see an increasing number of international firms looking to do deals in the U.S., overseas buyers have struggled to make inroads in a highly active marketplace already stacked with better-known, homegrown acquirers.

Looking Ahead

The second half of 2024 promises to be a busy one for serious buyers and investors and motivated sellers as high M&A activity and elevated valuations are expected to persist. With the engineering industry showing all indications of reaching new “peak consolidation” territory, many firm owners and leaders have decided there has never been a better time to sell their firms.

Recent Transactions – May 2024

- NV5 (Hollywood, Fla.) (ENR #24) acquired myBIMteam (Winter Haven, Fla.)

- Thompson & Litton (Wise, Va.) acquired Tysinger, Hampton & Partners (Johnson City, Tenn.)

- GAI Consultants (Homestead, Pa.) (ENR #166) acquired Creighton Manning Engineering (Albany, N.Y.)

- Barton & Loguidice (Liverpool, N.Y.) (ENR #286) acquired Penn Central Engineering (Centre Hall, Pa.)

- LJA Engineering (Houston) (ENR #67) acquired BM&K Engineering (Braselton, Ga.)

- VHB (Watertown, Mass.) (ENR #62) acquired McPherson Consulting (Virginia Beach, Va.)

- STV (New York City) (ENR #35) acquired MEHTA and Associates (Winter Park, Fla.)

- Sterling Investment Partners (Westport, Conn.) acquired Verdantas (Tampa, Fla.) (ENR #113)

- LaBella Associates (Rochester, N.Y.) (ENR #127) acquired ENGR3 (Alpharetta, Ga.)

- Traffic & Mobility Consultants (Orlando, Fla.) acquired Lincks & Associates (Tampa, Fla.)

- RESPEC (Rapid City, S.D.) acquired Enviromin (Bozeman, Mont.)

- Dunaway (Fort Worth, Texas) acquired CRIADO & Associates (Dallas)

- Clark Dietz (Champaign, Ill.) acquired RS Engineering (Lansing, Mich.)

- Kimley-Horn (Raleigh, N.C.) (ENR #10) acquired VICUS (Los Angeles)

- IMEG Corp. (Rock Island, Ill.) (ENR #57) acquired Rushing (Seattle)

- WSP (Montreal) (ENR #5) acquired AKF Group (New York City) (ENR #318)

- Bennett & Pless (Atlanta) acquired Linton Engineering (Potomac Falls, Va.)

Recent Transactions – April 2024

- Magnolia River Services (Decatur, Ala.) acquired Heath and Associates (Shelby, N.C.)

- Crafton Tull (Rogers, Ark.) (ENR #412) acquired Prism Design Studio (Huntsville, Ark.)

- LJA Engineering (Houston) (ENR #67) acquired Delta (Lubbock, Texas)

- PEA Group (Auburn Hills, Mich.) acquired ASTI Environmental (Brighton, Mich.)

- Infrastructure Consulting & Engineering (West Columbia, S.C.) (ENR #205) acquired IDCUS (Houston)

- Salas O’Brien (Irvine, Calif.) (ENR #39) acquired Industrial Ally (Chesterfield, Mo.)

- LJB (Miamisburg, Ohio) (ENR #350) acquired Gorrill Palmer (South Portland, Maine)

- Pape-Dawson Engineers (San Antonio) (ENR #112) acquired GradyMinor (Bonita Springs, Fla.)

- Bowman Consulting Group (Reston, Va.) (ENR #78) acquired Moore Consulting Engineers (Shamong, N.J.)

- Verdantas (Dublin, Ohio) (ENR #149) acquired Project Navigator (Tustin, Calif.)

- Legence (San Jose, Calif.) acquired P2S (Long Beach, Calif.) (ENR #308)

- TranSystems (Kansas City, Mo.) (ENR #65) acquired NCM Engineering (Rancho Santa Margarita, Calif.)

- Verdantas (Dublin, Ohio) (ENR #113) acquired CT Consultants (Mentor, Ohio) (ENR #339)

- NV5 (Hollywood, Fla.) (ENR #24) acquired GIS Solutions (Springfield, Ill.)

- Bowman Consulting Group (Reston, Va.) (ENR #78) acquired Surdex Corporation (Chesterfield, Mo.)

- Godspeed Capital Management (Washington, D.C.) acquired a majority stake in Infrastructure Consulting & Engineering (West Columbia, S.C.) (ENR #198)

- Structura (North Bethesda, Md.) acquired Fitzpatrick Engineering Group (Charlotte, N.C.)

- Ulteig (Fargo, N.D.) (ENR #123) acquired Affinity Energy (Charlotte, N.C.)

- Coffman Engineers (Seattle) (ENR #161) signed LOI to acquire Donald F. Dickerson Associates (Tarzana, Calif.)

- PS&S (Warren, N.J.) (ENR #359) acquired Stout & Caldwell (Cinnaminson, N.J.)

- Halff Associates (Richardson, Texas) (ENR #85) acquired Singhofen & Associates (Orlando, Fla.)