Headline: Big Buyers, Sellers Reshape Industry M&A

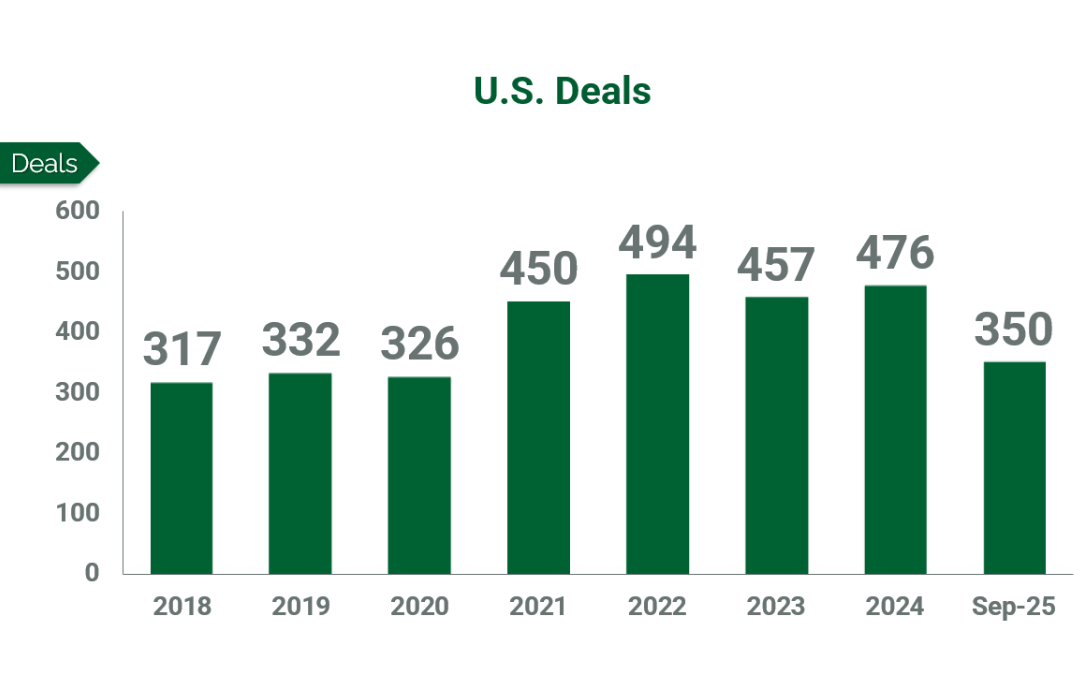

Following a surge in merger and acquisition (M&A) activity in 2021, the A/E and environmental industry has experienced unprecedented consolidation. Shaking off challenges such as tariff uncertainty, global unrest, and stock market volatility, industry deal-making remained robust through the first three quarters of 2025—averaging more than one transaction per day, with ACEC members very much in the middle of deal-making.

As of mid-September, Morrissey Goodale had tracked 350 deals involving U.S. design and environmental firms in 2025—a number that has already eclipsed pre-pandemic records. We expect 2025 to mark the fifth consecutive year with an annual deal volume of 450 transactions or higher.

That level of consistent performance, sustained through shifting economic and capital environments, reflects a mature and resilient M&A landscape. More firms are approaching deals with clear goals, such as succession or strategic repositioning, and capital continues to flow toward targeted acquisitions.

Both buyers and sellers grew significantly larger in 2024 and have maintained most of those gains in 2025. The median buyer size, which more than doubled from $68.8 million in 2022 to $144.8 million in 2024, remained elevated at $142.0 million through the first three quarters of 2025. After spiking 43 percent in 2024, the median seller size also held steady at a near-record $4.0 million thus far in 2025.

Reflecting the strong preference among the industry’s biggest players to grow through acquisitions, organizations listed on Engineering News-Record’s (ENR) Top 500 Design Firms have captured a growing share of domestic M&A activity, rising from 40 percent in 2020 to 45 percent through the first three quarters of 2025. Of the 54 deals involving ACEC member firms between May and September, all but five were completed by ENR 500 buyers. Notably, three transactions involved both ENR 500 buyers and sellers:

- Clark Nexsen (Virginia Beach, Va.) (ENR #255) merged with Johnson, Mirmiran & Thompson (Hunt Valley, Md.) (ENR #50)

- H.W. Lochner (Chicago) (ENR #98) joined forces with Egis Group (Indianapolis, Ind.) (ENR #139)

- Manhard Consulting (Lincolnshire, Ill.) (ENR #329) was acquired by Atwell (Southfield, Mich.) (ENR #70)

The increasing deal sizes reflect the growing influence of private equity (PE) in the market. PE and PE-backed transactions have risen for eight consecutive years—growing more than seven-fold from 27 deals in 2016 to 197 in 2024. With 165 transactions by PE and PE-backed firms recorded through mid-September, 2025 is poised for another year of growth.

Meanwhile, employee-owned buyers have ceded ground. Their share of total deals has declined every year but one since 2018, plummeting from 80 percent in 2016 to just 50 percent in 2024.

If current trends hold, 2025 could mark the first year in which PE represents the largest share of buyers. So far this year, PE and PE-backed acquirers have accounted for 47 percent of all transactions, compared to 45 percent for employee-owned firms. Publicly traded buyers made up the remaining 8 percent of transactions, consistent with their share in recent years.

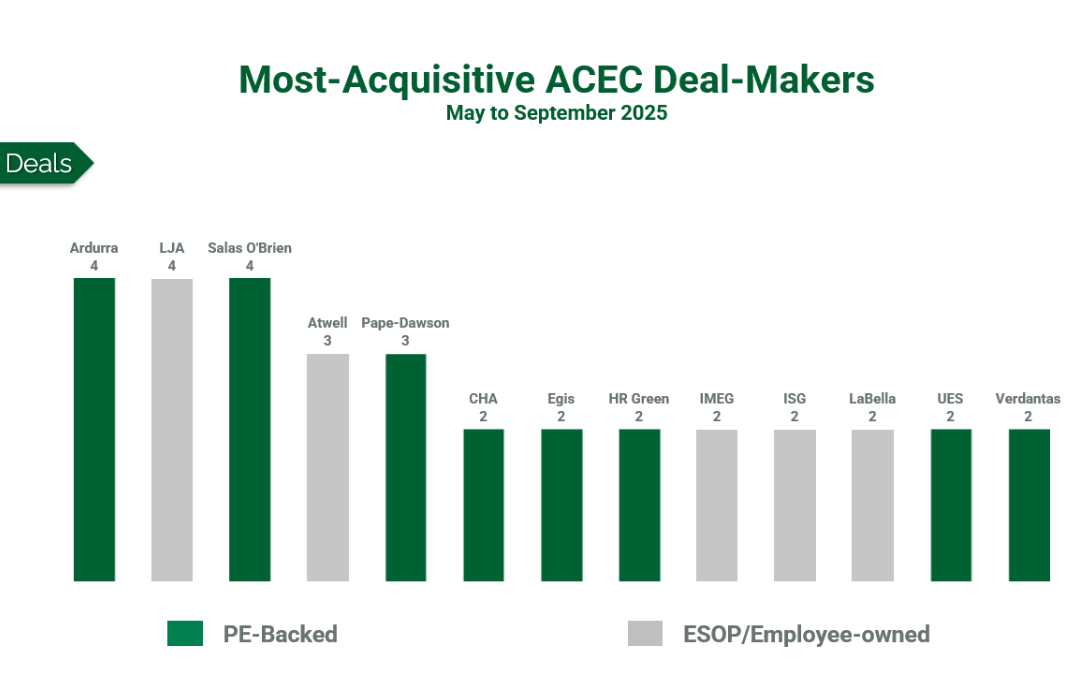

The presence of institutional capital in the industry is no longer novel; it is entrenched. Nearly half (48%) of the deals involving ACEC member firms between May and September were backed by PE. One in four ENR 100 firms is now PE-backed, up from just 4 percent in 2017. Over the same timeframe, the share of employee-owned firms in the ENR 100 dropped from 74 percent to 58 percent.

Thirteen ACEC member firms made multiple acquisitions between May and September. Leading the pack with four acquisitions each were LJA Engineering (Houston), Salas O’Brien (Irvine, Calif.), and Ardurra Group (Miami)—winner of Morrissey Goodale’s 2025 M&A Best Practices Award. Pape-Dawson (San Antonio, Texas) and Atwell (Southfield, Mich.)—a 2025 winner of Morrissey Goodale’s Best M&A Post-Transaction Performance Award—made three acquisitions apiece. Eight of the 13 firms with multiple acquisitions are PE-backed.

Accounting for 30 percent of all A/E and environmental industry transactions over the past two decades, California, Florida, and Texas remain the most active states for deal-making. Between two-thirds and three-quarters of all deals in these three states involve out-of-state buyers, drawn by the sheer volume of opportunities in these massive economies that have infrastructure, building, and environmental needs that exceed those of most countries. The trio of Sun Belt powerhouses accounted for 39 percent of deals by ACEC member firms between May and September. Texas, Florida, and California each saw seven acquisitions, while North Carolina followed with five and New York with four.

Firms serving the transportation market were the most sought-after by ACEC buyers—with seven acquisitions between May and September. Close behind were site development and MEP firms, each with six deals, followed by water and multi-discipline firms, each with five acquisitions. These sectors are benefiting from strong infrastructure tailwinds and scalability that continue to drive strategic investment decisions.

Following is a list of recent transactions, with ACEC members highlighted in bold.

September 2025

Perteet (Everett, Wash.), an infrastructure consulting firm recognized for its award-winning transportation expertise and long-standing public agency partnerships, joined public industry leader Ardurra Group (Miami) (ENR #75).

REI Utility Services (Athens, Texas), a firm that offers power systems engineering and field services to electric utilities, acquired Torlan Engineering (Houston), a power systems engineering firm.

Industry leader Salas O’Brien (Irvine, Calif.) (ENR #31) merged with rCon Engineers (Woodbridge, Canada), a firm that provides civil and structural design, feasibility studies, general arrangement layouts, inspections, and design of remedial work for damaged structures to industrial clients. Salas O’Brien also expanded its MEP engineering expertise with the addition of AME Consulting Engineers (Charlotte, N.C.).

Civil engineering, environmental, and surveying firm Pape-Dawson Engineers (San Antonio, Texas) (ENR #69) acquired civil engineering and surveying firm Gaskins+ LeCraw (Marietta, Ga.). Pape-Dawson Engineers also expanded in Florida with the acquisition of Bonnett Design Group (Maitland, Fla.), a firm specializing in landscape architecture and planning.

GZA GeoEnvironmental (Norwood, Mass.) (ENR #140), a multidisciplinary firm providing geotechnical, environmental, ecological, water, and construction management services, has purchased the assets of Siefert Associates (Watertown, Conn.), a construction engineering firm recognized for delivering large-scale construction projects.

ZenaTech (Toronto, Canada), a technology firm specializing in Al drones, Orone as a Service (OaaS), enterprise Saas, and quantum computing solutions, acquired Lescure Engineers (Santa Rosa, Calif.), a civil engineering and land surveying firm.

Full-service engineering, design, consulting, and PM/CM firm CHA (Albany, N.Y.) (ENR #63) acquired Midwestern Engineers (Loogootee, Ind.), an engineering firm that offers water, wastewater, stormwater, and survey solutions.

Ardurra Group (Miami) (ENR #75) acquired J.R. Wauford & Company (Nashville, Tenn.), a nearly 70-year-old wastewater engineering firm, expanding its regional presence, and enhancing its ability to deliver innovative, sustainable infrastructure solutions.

Innovative geoscience, engineering, and technology firm RESPEC (Rapid City, S.D.) acquired Albertson Engineering (Rapid City, S.D.), a structural firm with experience in civic buildings, public art, commercial spaces, and industrial facilities.

August 2025

LaBella Associates (Rochester, N.Y.) (ENR #123), an architecture, engineering, environmental, and planning firm, acquired land surveying firm Welch & O’Donoghue (Avon, N.Y.).

Fast-growing industry leader Atwell (Southfield, Mich.) (ENR #70), acquired Manhard Consulting (Lincolnshire, Ill,) (ENR #329), a nearly 400-person engineering and surveying firm.

TRC Companies (Windsor, Conn.) (ENR #17), a global professional services firm providing integrated strategy, consulting, engineering, and applied technologies, acquired Strategic Energy Group (Portland, Ore.), an expert in strategic energy management (SEM).

Engineering Analytics (Fort Collins, Colo.), a civil and environmental engineering firm known for its expertise in site remediation, mining, water resources, municipal infrastructure, and power and energy, joined multidisciplinary consulting firm MacKay Sposito (Vancouver, Wash.).

LaBella Associates (Rochester, N.Y.) (ENR #123), an architecture, engineering, environmental, and planning firm acquired Environmental Assessment & Remediations (EAR) (Patchogue, N.Y.), a hydrologic and environmental consulting firm.

Collins Cooper Carusi Architects (Atlanta), a community focused design firm with expertise in early learning and K-12 education, higher education, on campus student housing, and recreation centers, joined global integrated design firm DLR Group (Omaha, Neb.) (ENR #67).

Green Companies (Cedar Rapids, Iowa), the parent company of the HR Green (Cedar Rapids, Iowa) (ENR #168) family of engineering firms, acquired Gauge Engineering (Houston), an engineering firm that specializes in transportation and drainage engineering analysis, design, and construction management services.

In a major transatlantic merger, Lochner (Chicago) (ENR #98), a nationally recognized transportation infrastructure planning and engineering services firm with 1,100+ professionals operating in 54 offices across 22 states, has merged with ENR’s #24 ranked global design firm, Egis (Guyancourt, France).

97 Land (Denton, Texas), a land development firm with expertise in land use and entitlements, economic development, PM, permit assistance, and strategic consulting, joined industry leader McAdams (Raleigh, N.C.) (ENR #262), a fast-growing full-service planning, design, and engineering firm.

Full-service transportation consulting and design firm DB Sterlin Consultants (Chicago) acquired M Squared Engineering (Itasca, Ill.), a firm that offers water resources, transportation engineering, and site development.

Ampirical Solutions (Covington, La.), an engineering and software services firm serving the power industry, acquired Cappstone Energy Group (Covington, Ga.), a utility engineering firm with expertise in distribution system planning, GIS development, and line design.

Employee-owned industry leader LJA Engineering (Houston) (ENR #52) acquired G&R Surveying (Austin, Texas), a land and civil construction surveying services firm.

Structural engineering firm Studio Engineers (Santa Barbara, Calif.) joined John A. Martin & Associates (Los Angeles), a firm that offers structural engineering, design-build, forensic engineering, and construction services.

July 2025

Naik Consulting Group (Edison, N.J.), an engineering firm with experience in commercial and transportation projects, entered a strategic partnership with Trilon Group (Denver), a family of infrastructure consulting businesses.

Design firm CPL (Fairport, N.Y.) (ENR #261) entered a new partnership with Andrews Architects (Columbus, Ohio), an architecture firm with healthcare expertise.

Infrastructure engineering and design firm Sanbell (Billings, Mont.) merged with Core Design (Bothell, Wash.), a civil engineering, planning, and landscape architecture firm.

Pioneering AEG and strategic consulting firm Woolpert (Dayton, Ohio) (ENR #39) acquired Dawood Engineering (Harrisburg, Pa.), an infrastructure and geospatial technology firm.

Engineering, architecture, and planning design firm TKDA (Bloomington, Minn.) (ENR #259) acquired CNA Consulting Engineers (Minneapolis), an engineering firm specializing in underground and geotechnical engineering.

Salas O’Brien (Irvine, CA) (ENR #31) merged with The Lighting Design Alliance (Long Beach, Calif.), a firm with design expertise in architectural and entertainment lighting.

Technology, conformity assessment, and consulting solutions firm NV5 (Hollywood, Fla.) (ENR #26) acquired Professional Systems Engineering (Lansdale, Pa.), a Northeast designer of facility technologies for corrections and public safety infrastructure.

Architecture and engineering firm ISG (Mankato, Minn.) (ENR #245) acquired landscape architecture and planning firm Lift Environmental Design (Durham, N.C.).

LJA Engineering (Houston) (ENR #52) continued its expansion in Texas with the acquisition of MESA Integrated Solutions (Austin), a transportation engineering firm that offers engineering software training, support, and engineering production services.

OHM Advisors (Livonia, Mich.) (ENR #207), an A/E and planning firm, acquired CIB Planning (Fenton, Mich.), a community development and urban planning firm.

Verdantas (Tampa) (ENR #81) acquired Independent Solutions (Lake Elsinore, Calif.), a firm with expertise in inspection and soil and materials laboratory testing, with a strong focus on the healthcare sector.

Barge Design Solutions (Nashville) (ENR #160) acquired Carlisle Associates (Columbia, S.C.), a firm specializing in architecture, civil, structural, mechanical, and electrical engineering. The acquisition expands Barge’s presence in South Carolina and strengthens its capabilities in the growing industrial sector.

Pennoni (Philadelphia) (ENR #114) acquired the assets of Dagher Engineering (New York, N.Y.), a building systems engineering and sustainability consulting firm offering fundamental building systems design and advanced high-performance services.

Bowman Consulting Group (Reston, Va.) (ENR #72) entered into a definitive purchase agreement to acquire e3i Engineers (Boston), a firm specializing in the design of data centers, energy infrastructure, and emerging technology applications.

Parsons Corporation (Chantilly, Va.) (ENR #16) acquired Chesapeake Technology International (CTI) (Prince Frederick, Md.), a firm focused on developing advanced, warfighter-focused solutions for military and security applications.

HP Engineering (Rogers, Ark.), a multidisciplinary firm providing MEP, fire protection, structural, lighting, low-voltage, energy modeling, and commissioning services, joined industry leader IMEG Corp. (Rock Island, Ill.) (ENR #48).

June 2025

Westwood Professional Services (Plano, Texas) (ENR #77) acquired program management consulting firm CSRS (Baton Rouge, La.), a firm that offers services to the education, healthcare, industrial, real estate development, resilience, and transportation markets.

Brown and Caldwell (Walnut Creek, Calif.) (ENR #41), an engineering consulting firm delivering water and environmental solutions throughout North America and the Pacific, acquired Separation Processes (San Marcos, Calif.) to expand its membrane technology services and expertise for water and wastewater clients.

Full-service engineering, design, consulting, and PM/CM firm CHA (Albany, N.Y.) (ENR #63) expanded in the West with the acquisition of FALCON Engineering Services (Temecula, Calif.), a firm that specializes in CM and engineering services for a wide range of civil engineering projects.

Salas O’Brien (Irvine, Calif.) (ENR #31) merged with BWK Engineering (Akron, Ohio), an MEP, fire protection, and technology design firm serving the architectural, industrial, institutional, and commercial sectors.

Court Square Capital Partners (New York, N.Y.) acquired a majority stake in DCCM (Houston) (ENR #116), a national provider of design, consulting, and construction management services.

Engineering and consulting firm Universal Engineering Sciences (UES) (Orlando) (ENR #40) acquired Geohazards (Gainesville, Fla.), a geology and engineering firm that offers forensic engineering, geology and geophysics, geotechnical engineering, geotechnical construction inspection, erosion control, and litigation support.

Multi-disciplined engineering and environmental firm GEI Consultants (Woburn, Mass,) (ENR #83) merged with GeoWest Engineering (Abbotsford, Canada), a firm specializing in geotechnical, gee-structural, and environmental engineering.

Stantec (Edmonton, Canada) (ENR #8) acquired Cosgroves (Christchurch, New Zealand), a buildings engineering firm with fire engineering, electrical, mechanical, hydraulics, buildings sustainability, and civil expertise.

Infrastructure engineering and consulting firm Consor (Houston) (ENR #71) acquired Versa Infrastructure (Houston), a program and construction management firm that has experience working on surface transportation, aviation, flood protection, and water infrastructure projects.

Ardurra Group (Tampa) (ENR #75) acquired Janus Research (Tampa), a cultural resource management firm that ensures development projects meet federal and state preservation requirements.

Granger Water Specialties (Hanford, Calif.), a firm that provides management services for water and wastewater treatment plants, joined Provost & Pritchard Consulting Group (Clovis, Calif.), a civil and agricultural engineering, environmental, land use planning, hydrogeology, geology, surveying, and CM services firm.

Priority Power (The Woodlands, Texas), a firm with energy optimization and infrastructure expertise, acquired Thomas Engineering (Corpus Christi, Texas), an energy management and consulting firm.

The U.S. Design Collective team of CBRE Group (Dallas) joined Ware Malcomb (Irvine, Calif.) (ENR #156), a full-service design firm that provides architecture, planning, interior design, civil engineering, branding, and building measurement services.

Verdantas (Tampa) (ENR #81) acquired Surf to Snow Environmental Resources Management (San Ramon, Calif.), a firm with expertise in stormwater management, environmental planning and permitting, biological analysis, water and natural resources, erosion and sediment control, and site restoration services.

BNP Associates (Denver), an air transportation design and engineering firm, acquired Establish (New York, N.Y.), a global consulting firm specializing in warehousing and supply chain logistics.

WGI (West Palm Beach), a design and professional services firm, acquired all assets of Roadway Design Services (Miami), a civil engineering consulting firm that specializes in transportation design.

May 2025

Engineering, architecture, and consulting firm Stratus Team (Coraopolis, Pa.) (ENR #217) acquired Kilian Engineering (Raleigh, N.C.), a mechanical, electrical, plumbing, and fire alarm design services firm.

Private investment firm Littlejohn & Co. (Greenwich, Conn.) acquired RailPros (Irving, Texas), a provider of engineering and field services for the rail and transit market.

Johnson, Mirmiran & Thompson (Hunt Valley, Md.) (ENR #50), a 100 percent employee-owned leader in engineering, architecture, technology, and consulting, merged with Clark Nexsen (Virginia Beach, Va.) (ENR #255), a multidisciplinary A/E firm. The combination forms one of the largest ESOP-owned firms in the A/E industry.

Engineering, planning, and geospatial services firm McKim & Creed (Raleigh, N.C.) (ENR #167) announced its intent to acquire Landmark Science & Engineering (Newark, Del.), a firm that specializes in civil engineering, surveying, and natural environmental sciences.

Acuren Corporation (Tomball, Texas), a provider of critical asset integrity services to industrial markets, entered into an agreement to merge with NV5 Global (Hollywood, Fla.) (ENR #26), a technology, conformity assessment, and consulting solutions firm.

Galloway & Company (Greenwood Village, Colo.) (ENR #318), a national multidisciplinary architecture and engineering firm, announced a strategic growth investment from ARA Service Partners (New Hope, Pa.) and Kelso & Company (New York, N.Y.).

Architecture, engineering, environmental, and planning firm ISG (Mankato, Minn.) (ENR #245) acquired JDAVIS (Raleigh, N.C.), a multi-disciplinary design firm with expertise in planning, landscape architecture, interior design, architecture, and procurement management services.

Lynch Mykins (Raleigh, N.C.), a structural engineering and special inspections firm, joined industry leader IMEG Corp. (Rock Island, Ill.) (ENR #48).

DTR Consulting Services (Roseville, Calif.), a consulting firm with expertise in technical architecture, building envelope design, and building science, joined ECS Group of Companies (Chantilly, Va.) (ENR #66), a geotechnical, construction materials, environmental, and facilities services firm.

Pape-Dawson Engineers (San Antonio, Texas) (ENR #69) acquired Morris Engineering & Consulting (Sarasota, Fla.), a civil engineering firm that provides land development services.

Green Companies (Cedar Rapids, Iowa), the parent company of the HR Green (Cedar Rapids, Iowa) (ENR #168) family of engineering firms, acquired Infrastructure Solution Services (Melbourne, Fla.), a firm with experience in water supply and treatment, stormwater management, civil site design, disaster recovery, surveying, and grant writing.

The HFW Companies (St. Louis, Mo.) (ENR #203), an expanding professional services firm in the A/E industry, formed a strategic growth partnership with civil engineering firm Southwest Engineers (Gonzales, Texas).

Engineering, architecture, design, and consulting firm Colliers Engineering & Design (Holmdel, N.J.) (ENR #32) acquired Terra Consulting Group (Park Ridge, Ill.), a specialty telecommunications infrastructure engineering firm.