Co-Locating Data Centers with Nuclear Power for a Resilient Energy Future

The rapid expansion of data centers is driving a significant surge in electricity consumption, now accounting for 6-8% of total U.S. power generation, with 75% of major utilities reporting increased strain on the power grid (Deloitte). As tech companies accelerate development to meet escalating digital infrastructure demands, job postings have also increased—rising 344% in data centers, 136% in distributed energy, and 56% in the nuclear sector—illustrating the industry’s growing need for alternative energy sources.

The Case for Nuclear-Powered Data Centers

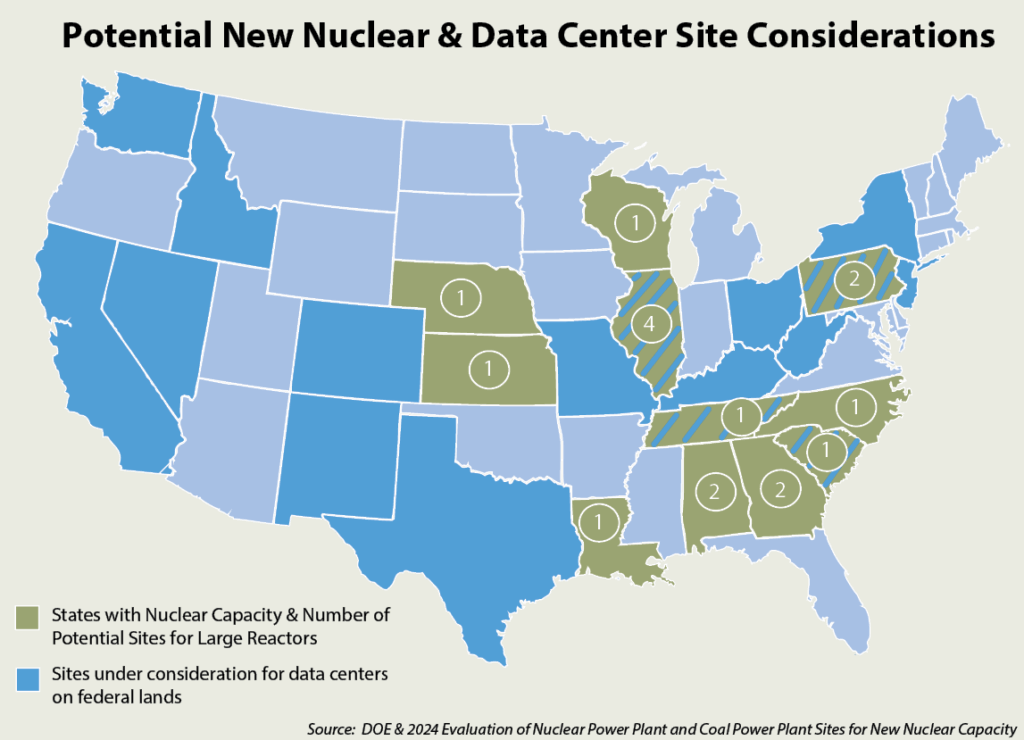

With rising electricity consumption, nuclear power is emerging as a potential player in supporting stable, uninterrupted operations for data centers. Large-scale nuclear facilities can offer consistent baseload power, minimizing fluctuations and vulnerabilities tied to intermittent energy sources like wind and solar. Recognizing this potential, data center developers are increasingly co-locating sites near nuclear reactors to ensure grid reliability. The Idaho National Laboratory, through a report created for the Department of Energy (DOE), identified up to 37 sites with potential for large reactor expansion, reinforcing nuclear’s potential role in fortifying energy infrastructure. See the map for 17 operable Nuclear Power Plant (NPP) sites with the potential for an additional large reactor.

Federal Initiatives Supporting Co-Location

To further facilitate expansion, the DOE is actively promoting data center development on federal land alongside existing power sources, particularly nuclear facilities. Energy Secretary Chris Wright underscored this initiative at the National Renewable Energy Laboratory (NREL) in Colorado, highlighting public-private partnerships as a mechanism to fund new projects. The DOE has issued a request for information (RFI) identifying 16 federal sites (the National Energy Technology Laboratory (NETL) had 3 optional sites including two on the NETL Pittsburgh Campus, Pennsylvania, and one on the NETL Morgantown Campus, West Virginia) for AI-related infrastructure and exploring strategic partnerships to support surging electricity demands. The RFI presents opportunities for nuclear, geothermal, and energy storage integration, emphasizing streamlined permitting processes to accelerate implementation.

Advancing Nuclear Technology for Digital Growth

Beyond traditional nuclear plants, emerging technologies like small modular reactors (SMRs) can offer scalable and cost-effective solutions for powering data centers. The DOE recently allocated $13 million through the Advanced Nuclear Energy Licensing Cost-Shared Grant Program to support bringing advanced reactors to market. The grant will remain open for five years with up to $50 million available aimed at accelerating the deployment of advanced nuclear reactor designs by covering associated licensing fees charged by the Nuclear Regulatory Commission (NRC).

Global Nuclear Expansion and U.S. Leadership

The trend toward nuclear-backed digital infrastructure extends beyond the U.S. According to the World Nuclear Association, there are currently 440 reactors operational worldwide, with 66 additional reactors under construction, reflecting a global commitment to nuclear energy solutions. The 2024 State of the Markets Report by the Federal Energy Regulatory Commission (FERC) highlights nuclear additions such as Vogtle Unit 4 Nuclear Reactor (1,114 MW) and large-scale solar projects supporting diversified energy growth.

As demand for high-performance computing and AI accelerates, nuclear-powered data centers could offer a resilient, long-term opportunity for sustaining the energy-intensive digital economy. By co-locating with nuclear plants, companies could mitigate grid instability while advancing clean energy objectives in the U.S. and beyond.