ACEC Continues Opposition to FHWA Procurement Rule

The Council is aggressively opposing a proposed change from the Federal Highway Administration (FHWA) to the regulations governing the procurement, management, and administration of engineering and design services by local governments on federally funded projects.

Under the proposed rule, compliance with Qualifications-Based Selection (QBS) would be optional for local projects funded through FHWA discretionary grants. The agency would remove the requirement that local governments award contracts for engineering and design-related services in accordance with QBS. It would also remove the requirement that contracts comply with the Federal Acquisition Regulation cost principles, another critical protection.

“Existing FHWA requirements directly impact public health and safety and play a key role in controlling costs and promoting project success. They ought to be maintained,” Council President and CEO Linda Bauer Darr wrote in a comment letter to FHWA Administrator Shailen Bhatt.

ACEC also organized a joint comment letter with the American Society of Civil Engineers, the American Road & Transportation Builders Association, the Associated General Contractors of America, and the National Society of Professional Engineers.

“Our collective members have been working diligently with our state and local partners for the last two-and-a-half years to deliver on the promised benefits of the historic investments included in the Bipartisan Infrastructure Law,” the groups wrote to FHWA Administrator Bhatt. “Unfortunately, we believe the changes put forward in this Notice of Proposed Rulemaking would be a step backward in achieving that shared goal.

“We recognize the challenges that FHWA and many local entities have encountered in administering their grant awards. However, waiving well-established, proven federal regulations is not the solution.”

The groups also met with senior agency officials to reiterate their concerns and express support for alternative options.

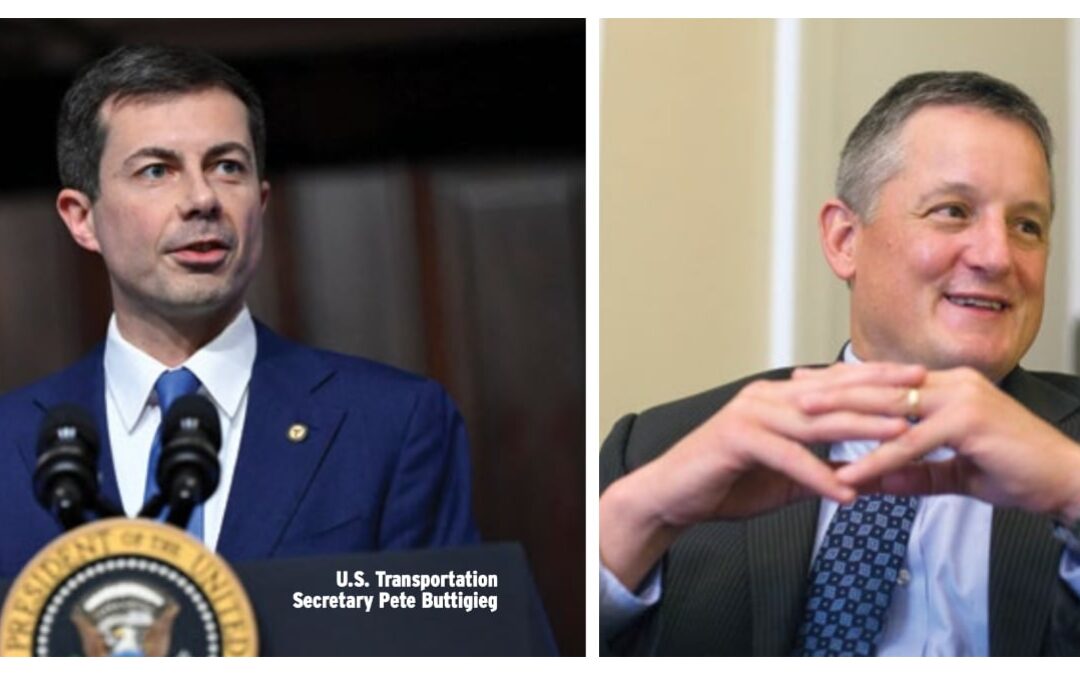

At a House Transportation and Infrastructure Committee oversight hearing with U.S. Secretary of Transportation Pete Buttigieg, Congressman Bruce Westerman (R-Ark.)—a registered professional engineer—spoke to Secretary Buttigieg about the issue:

“I’ve heard serious concerns from engineering companies about the potential impact of this change… Can you please ensure that the Administration will carefully consider the views of the engineering community and the potential negative impact of the proposed rule on public safety and project costs?”

Secretary Buttigieg pledged to consider the industry’s concerns. “We want to make sure that anything we do that affects the relationship with the engineering community is responsible and conducive to good, effective, safe project delivery,” he said.

Federal Trade Commission Noncompete Agreement Ban Blocked

A federal judge blocked implementation of the Federal Trade Commission’s (FTC’s) ban on noncompete agreements shortly before the September 4 effective date.

The rule would have stopped enforcement of noncompete agreements, including those executed before September 4. There were limited exceptions for existing noncompetes with senior executives and for noncompetes with owners of a business that is being sold.

The FTC may appeal the ruling, but the new Supreme Court decision in Loper Bright Enterprises vs. Raimondo could impact any higher court decisions. A core argument in the lawsuit against the FTC noncompetes ban has been that Congress did not grant the agency the authority to implement such a ban. Under the Loper Bright decision, courts can no longer give deference to agencies’ reading of the law and must independently interpret statutes.

Post-Election Options for R&D Amortization Fix

At the end of July, the Senate took a procedural vote on the House-passed Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) but failed to move forward. The legislation addresses a key ACEC priority by delaying the research and development (R&D) amortization requirement until 2026. Other provisions in H.R. 7024 include a delay of the limits on interest deductibility and the full expensing of capital equipment purchases. The package also expands the child tax credit, with an emphasis on low-income families.

Depending on the election results, it is possible that the Senate could vote again on H.R. 7024 before the end of 2024. If Congress does not move tax legislation during the lame duck session, a fix for R&D amortization could be in the mix during the 2025 tax debate over the expiration of significant portions of the 2017 tax reform law. These include the Section 199A passthrough tax deduction and lower individual tax rates, among other provisions. The corporate tax rate is also expected to be part of that debate.

ACEC is continuing to work with coalition allies to push for the earliest possible fix for R&D amortization.