Construction Spending Rises Slightly Amid Ongoing Sector Weakness

Recently, the US Census released the results of its monthly Value of Construction Put in Place Survey (VIP). The survey provides estimates of the total dollar value of design and construction work done in the U.S. This data includes spending for public and private projects. Due to the government shutdown, this is the first time we have seen data released since November 17th, 2025. This VIP contains initial estimates for October and September 2025 data.

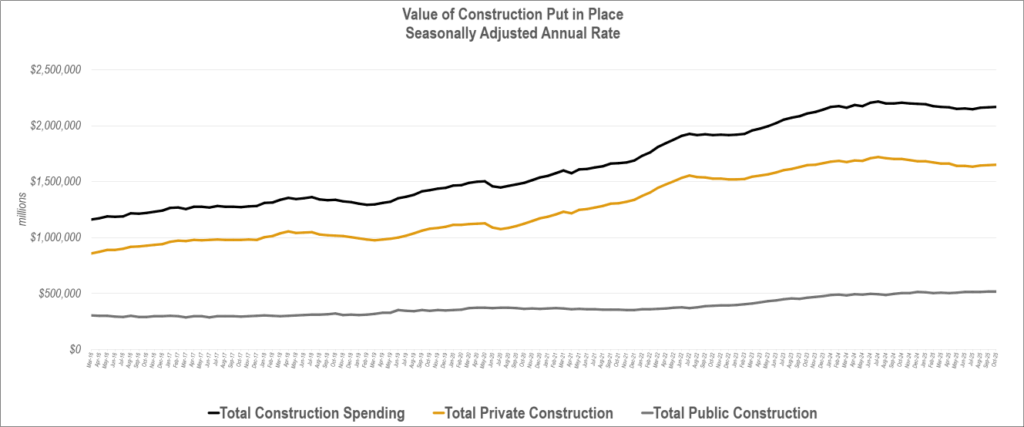

Total construction for October 2025 was $2.18 trillion, up 0.5% from September but down 1.0% year over year. Spending edged up slightly from September but remained below 2024 levels. Private construction was $1.65 trillion, up 0.6% from September driven by a 1.4% increase in the residential sector, an indication that housing demand is still resilient. Non-residential spending continued to see declines hinting at softness in investor activity. Total public construction was $524 billion, up 0.1% from September suggesting growth subdued but remained stable.

Source: US Census VIP Survey January 21, 2026, release

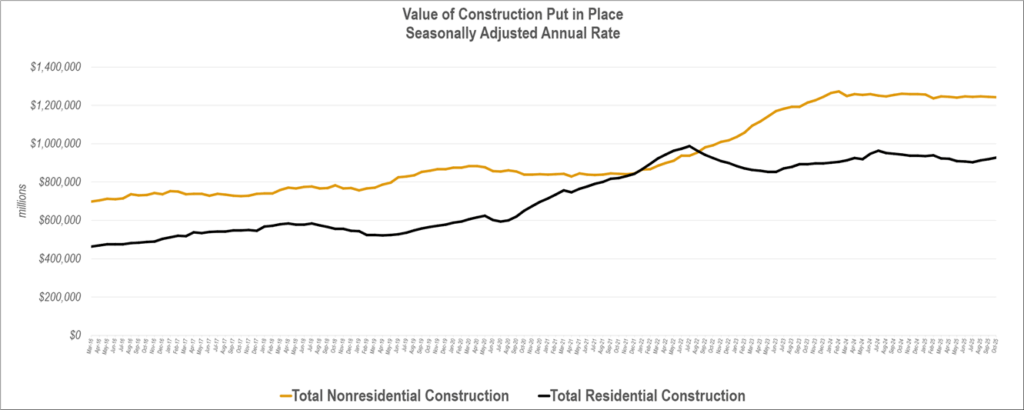

Overall investors appear to remain cautious despite real GDP growth of 4.4% in Q3 2025, an increase from 3.8% growth in Q2 2025. The recent rise was driven by higher consumer spending, exports, government spending, and investment while imports decreased. The residential market—a large contributor to GDP growth—showed slight improvement up 1.3% month over month while non-residential spending declined, down 0.2%, led by continued weakness in commercial and manufacturing sectors.

Source: US Census VIP January 21, 2026, release

Sewage and waste disposal, up 14.1% and water supply, up 6.5% lead year-to-date market-specific growth. Conservation & development joined the top 5 markets, up 5.7% while sectors that previously led growth remain missing. Amusement & Recreation dropped from the top 5 this month but still shows relatively similar growth up 5.0%. Manufacturing’s descent continues, down –5.3% but the largest negative driver is commercial, down –9.4%.